About Sole-trade

Our Company & Core Mission

Sole-trade is a leading global systematic investment manager. We deliver powerful investment, advisory, and risk management solutions worldwide by blending deep market insight with cutting-edge technology. Our specialized approach targets success across diverse assets, including Forex, Spot Metals, Cryptocurrencies, Stocks, and Real Estate.

As an independent online trader and fund manager, Sole-trade manages funds with a focus on diversification. Our income is generated through strategic investments in multinational corporation stocks, profitable government bonds, forex and crypto trading, and diversified real estate ventures. We share these profits with our investors as a percentage of their portfolio value, ensuring transparent transactions and sustainable financial growth.

Our Commitment to Risk Management

We recognize that all financial markets involve risk. Our strategy to minimize this risk involves rigorous analysis and competent fund allocation. Our analysts monitor the market twenty-four hours a day, leveraging extensive knowledge and experience to maximize diversification and significantly reduce potential risks. This commitment ensures we efficiently benefit from market movements for both the company and our investors.

Sole-trade maintains a high standard through constant implementation of modern technologies and advanced trading methods. Our highly qualified team operates as a single, precise unit capable of solving complex tasks and forecasting market shifts with high predictive accuracy. Our focus on minimal risk and detailed market analysis ensures the high financial growth of our company.

Our Historical & Future Milestones

Our journey began with an early realization of Bitcoin’s potential in 2011. By 2017, a core team of traders was formed, leading to the official launch of the Sole-trade startup in 2019. This quickly evolved into a powerful commercial entity managing investments worldwide.

Key Milestones:

- 2020: Formed a large, multi-disciplinary team of over 150 trading professionals and developed advanced predictive analysis algorithms.

- 2021: Transformed into a fully formed commercial company with official licensing. Launched our global online investment platform and began intensive international expansion.

- 2022-2023: Focused on platform upgrades, including **automation of financial processes**, creation of on-platform crypto wallets, and the development of our proprietary **ATR token** for commercial ecosystem expansion.

- 2024-2026 (Progressive Vision): Strategic plans include issuing our ATR token on exchanges, running an **Initial Public Offering (IPO)** tied to the token value, increasing trading instruments to 30, and launching related business lines like **Sole-trade Pay** and **Sole-trade Logistic**.

Our Sustainability Principles

Our sustainability commitments and ambitions apply across the investments we manage as an asset owner and manager, and to our internal business operations.

Our Core Commitments:

Strategic Integration: We integrate sustainability and ESG (Environmental, Social, and Governance) factors into our corporate strategy and risk management.

Responsible Management: We uphold the same principles of responsible action in managing our own business as we require of our investee companies.

Stakeholder Focus: We prioritize the interests of all stakeholders, ensuring our long-term approach to sustainability is consistent and transparent.

Active Ownership: We use our global influence to drive positive policy change and encourage companies to transition towards a sustainable future.

Core Principles

- Our priority is always to act in the best interests of our clients.

- We conduct business with the highest level of honesty and integrity.

- We strive to generate superior returns and welcome challenges others avoid.

- Creativity is at the core of our investment approach.

- Our most important asset is our people, and we stress teamwork in everything we do.

- We value the opinion of every member and seek consensus across all investment decisions.

Our Sustainability Strategy

ESG Integration

We integrate environmental, social, and governance information into our analysis and investment decision-making across all our teams and business lines.

Stewardship

We are active stewards of the entities in which we invest; this goes hand-in-hand with our active investment approach.

Corporate Responsibility

ESG is ingrained in our business activities, including our philanthropic programs and strong focus on diversity, equity, and inclusion across our firm.

Our Governance & Partnerships

Dedicated Resources

Our dedicated resources help develop and deliver our ESG strategy, policy, research, training, and reporting.

Industry Partnerships

We are a signatory to the **Principles for Responsible Investment (UN PRI)**, a member of the United Nations Global Compact and Climate Action 100+, and supporters of the Task Force on Climate-related Financial Disclosures.

Formal Governance

Our Sustainability Committee, composed of senior business leaders, oversees strategy execution. **Sustainability Working Groups** focus on long-term projects, ensuring accountability and measurable progress.

How We Work

Outstanding Team

Sole-trade is a tightly knit group of over 70 investment professionals, including 24 partners with an average tenure of over a decade. This experience allows us to devote substantial time and expertise to the companies in which we invest.

Collaborative Style

Our objective is to collaborate with portfolio company leadership to create an environment where companies can thrive. Our philosophy is to leave companies better than we found them, which often encourages portfolio employees to invest alongside Sole-trade.

Alignment of Interest

We believe transparency and a clear alignment of interest are vital for success. Our focus and significant direct investment alongside our partners allows us to build genuine, successful, and transparent partnerships.

Investment Criteria

Sole-trade targets investments in companies that demonstrate a sustainable competitive advantage and strong fundamentals in attractive, niche industries. Key criteria include:

- Led by managers with an established track record of achievement.

- Ability to grow, innovate, and withstand economic downturns.

- Strong market positions, attractive cash flow attributes, and high return on investment.

- Excellent organic or acquisitive growth prospects.

Our Values

At the heart of our business are our partners: the entrepreneurs and management teams we back, the investors in our funds, and the institutions we work with.

Highly Ambitious

We strive to build world-class businesses to generate superior returns for our partners. We're committed to constantly improving our processes.

Winning

We are here to win by constantly improving. We commit to out-thinking and out-executing our competitors, solving hard problems, and hiring the best talent.

Integrity

We do things the right way, without compromise. We are direct, decisive, and accountable, conforming to the letter and spirit of the law at all times.

Learning

We are driven by a thirst for knowledge. We passionately pursue new ideas, innovations, and strategies that strengthen our competitive advantage and expertise.

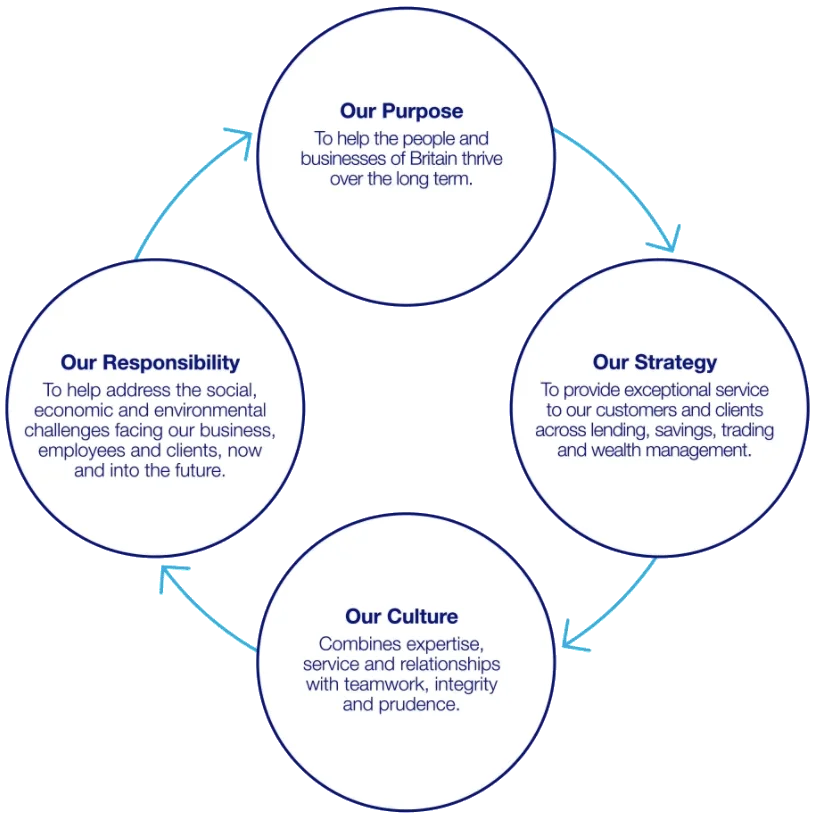

Our Purpose

Our purpose is to support our colleagues, clients, and communities. We help people and businesses unlock their potential and plan for the future with confidence, building relationships that stand the test of time. This long-term strategic approach places exceptional service at the heart of everything we do.

A combination of expertise, strong service, and robust relationships—underpinned by teamwork, integrity, and prudence—gives us the tools to thrive over the long term. We are committed to addressing the social, economic, and environmental challenges facing our business and clients, now and into the future.

Responsible Investing at Sole-trade

We believe we can make a difference in the world through our investments.

As a signatory to the United Nations Principles for Responsible Investment (UN PRI), we are committed to incorporating ESG considerations into our investment approach.

Our Approach to ESG and Responsible Investing

Our Systematic Approach

We believe markets are largely efficient and strive to provide systematic exposure to risk-based and behaviorally driven factors. Our ongoing research ensures our strategies maintain style and returns consistency while continually evaluating new data and quantitative methods.

We have a long history of accommodating client-specific requests and exclusions, such as those related to social or environmental concerns, or operations in regions where human rights abuses are prevalent.

We vote proxies on behalf of clients using Institutional Shareholder Services, Inc. (ISS) for research and execution, typically following the ISS Socially Responsible Investing (SRI) Proxy Voting Guidelines.

Risk Management at the Center

We manage risk to capitalize on opportunities and improve performance. Disciplined risk estimation and management are deeply integrated components of every investment strategy we employ.

We believe a well-constructed portfolio should outperform in good markets and protect client capital in difficult ones. For this reason, Sole-trade has made risk management a core discipline for over a quarter of a century. This approach is reinforced by a dedicated governance group, an emphasis on liquid markets, proprietary risk models, and a diversified funding structure.

The Sole-trade Way

A Dedicated Risk Management Team

The Portfolio Construction and Risk Group (PCG) operates independently of the investment businesses, reporting directly to the CEO to guide the allocation of risk capital. PCG is supported by a dedicated R&D team that creates custom tools and technologies.

The Risk Management Center

The Sole-trade Risk Management Center provides a comprehensive, real-time view of all investment portfolios. Built in 2014, its systems connect globally, continuously running operational readiness, risk, and stress test monitors to visualize data for rapid comprehension.

Run Rigorous Processes

In pre-trade discussions, the PCG identifies the impact of potential trades on a portfolio's risk and stress exposures. Through ex-post analysis, the group evaluates the skill and infrastructure of each business, using this data to inform the risk capital allocation process.

Reinforce the Culture

Successful risk management is a central part of every portfolio manager's decision-making. Continuous communication and collaboration with investment teams, combined with an in-depth understanding of the portfolios, is critical in maintaining and strengthening our robust risk culture.